16-18 ESFA Funded Provision (Includes 19-24-year-olds with EHCP)

Learners who are/will be 16, 17 or 18 on the 31st August in the calendar year when they begin a programme of study, will NOT pay tuition fees, registration fees or examination fees.

Where clothing or equipment is necessary for the student’s health or safety, a charge may be made for clothing and equipment that the student retains, but only if the student also has the option of borrowing the clothing or equipment free of charge.

In certain areas students will be encouraged to purchase their own kit, which they can take with them when they leave.

The College may charge for examinations and re-sits when funding criteria are met. A full set of charges rules in relation to 16-18-year-old learners can be found in the ESFA Funding Guidance for Young People here

Adult Education Provision – Classroom based

The devolution of adult education functions to specified combined authorities and the Mayor of London will apply in relation to the academic year from 1 August 2019. The following Combined Authorities will exercise, in relation to their area, certain adult education functions of the Secretary of State under the Apprenticeships, Skills, Children and Learning Act 2009.

The College will be subject to different Adult Education Budget funding rules dependent on the residency of the learner.

EU, other EEA and Swiss nationals will no longer be eligible for ESFA funded adult education budget funding in England for courses starting in academic year 2021 to 2022. This will not affect students starting courses in academic year 2020 to 2021. It will also not apply to Irish nationals living in the UK or Ireland whose right to study and to access benefits and services will be preserved on a reciprocal basis for UK and Irish nationals under the Common Travel Area arrangement.

Adult Education Provision – resident of LCR (funded by LCRCA)

Learners unless otherwise agreed in writing with the Combined Authority. Learner postcodes can be checked for eligibility at https://www.gov.uk/find-local-council

The following is an extract from the Adult Education Budget performance – management rules funded by the LCRCA:

LCR AEB Contribution Table 1: Learners aged 19 to 23 year

| Provision | 19-23-year-olds | Notes |

| English and maths, up to and including level 2

|

Fully funded | Must be delivered as part of the legal entitlement qualifications |

| Essential Digital Skills Qualifications, up to and including level 1 | Fully funded | Must be delivered as part of the Digital legal entitlement qualifications list |

| First full level 2 (excluding English & maths and Digital) | Fully funded | First full level 2 must be delivered as part of the legal entitlement qualifications or for those eligible through unemployed or on a low income wage or due to LCRCA specified flexibility |

| Learning aims to progress to a full level 2 – up to and including level 1 | Fully funded | Must be delivered as entry or level one provision from local flexibility |

| Level 3 legal entitlement (learners first full L3) other qualifications included in the level 3 Adult Offer | Fully funded | First full level 3 must be delivered as part of the legal entitlement qualifications |

| Level 3 Adult Offer | Fully funded | Learners without a full level 3 or above can access a qualification on the level 3 adult offer qualification list |

| Level 3 Advanced Learner Loan | Loan funded | A learner has already achieved a full level 3 (Advanced Learner Loans funding rules – not funded via LCRCA) |

| English for Speakers of Other Languages (ESOL) learning up to and including level 2 | Fully funded | For those eligible through unemployed or on a low wage or due to LCRCA specified flexibility |

| Learning aims up to and including level 2, where the learner has already achieved a first full level 2, or above | Fully funded | For those eligible through unemployed or on a low wage or due to LCRCA specified flexibility |

LCR AEB Contribution Table 2: Learners aged 24+

| Provision | 24+ | Notes |

| English and maths, up to and including level 2 | Fully funded | Must be delivered as part of the legal entitlement qualifications list |

| Essential Digital Skills Qualifications, up to and including level 1 | Fully funded | Must be delivered as part of the legal entitlement qualifications list |

| Level 2 (excluding English & maths) | Fully funded | For those eligible through unemployed or on a low wage |

| Learning to progress to level 2 | Fully funded | For those eligible for their first full level 2 through unemployed or low wage or due to LCRCA Level 2 flexibility |

| Level 3 Adult Offer | Fully funded | Learners without a full level 3 or above accessing a qualification on the level 3 adult offer qualifications list |

| Level 3 Advanced Learner Loan | Advanced Learning Loan funded | All 24+ learners who are not eligible for the level 3 adult offer must refer to advanced learner loans.

(Advanced Learner Loans funding rules – not funded via LCRCA) |

| English for Speakers of Other Languages (ESOL) learning up to and including level 2 | Fully funded | For those eligible through unemployed or on a low wage or due to LCRCA specified flexibility |

| Learning aims up to and including level 2, where the learner has already achieved a first full level 2, or above | Fully funded | For those eligible through unemployed or on a low wage or due to LCRCA specified flexibility |

| Learning aims up to and including level 2, where the learner has not achieved a first full level 2, or above | Fully funded | For those eligible through unemployed or on a low wage or due to LCRCA specified flexibility |

Exam fees

No exam fee to be charged as tuition fee is set at the maximum loan/weighted fee available. Fees may be charged for re-sits and/or retakes.

Kits and Uniforms

Basic kit and uniforms will be made available where applicable. In certain areas students will be encouraged to purchase their own kit, which they can take with them when they leave.

Unemployed status

For funding purposes, we define a Learner as unemployed if one or more of the following apply:

Low wage flexibility referred to must be eligible for co-funding and earns less than £31,600.40 annual gross salary.

Adult Education Provision – resident of non-devolved area (funded by ESFA)

The following is an extract from the Adult Education Budget performance – management rules funded by the ESFA:

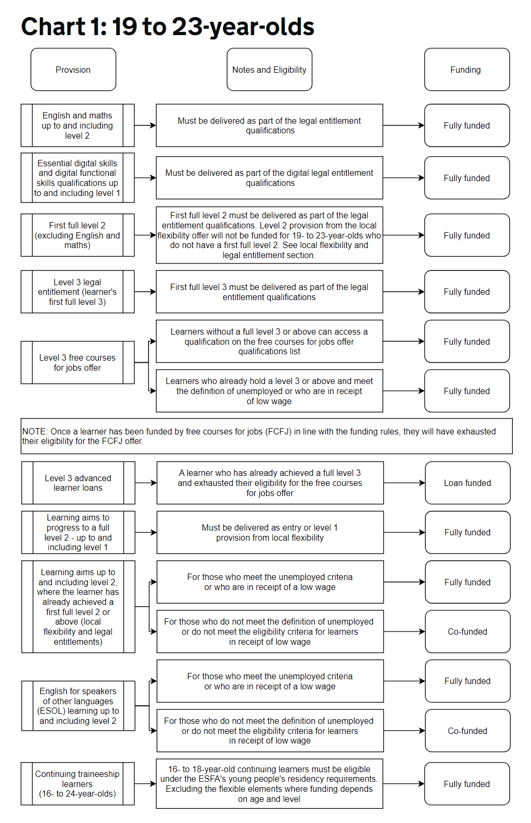

Government contribution table 1: 19 to 23-years

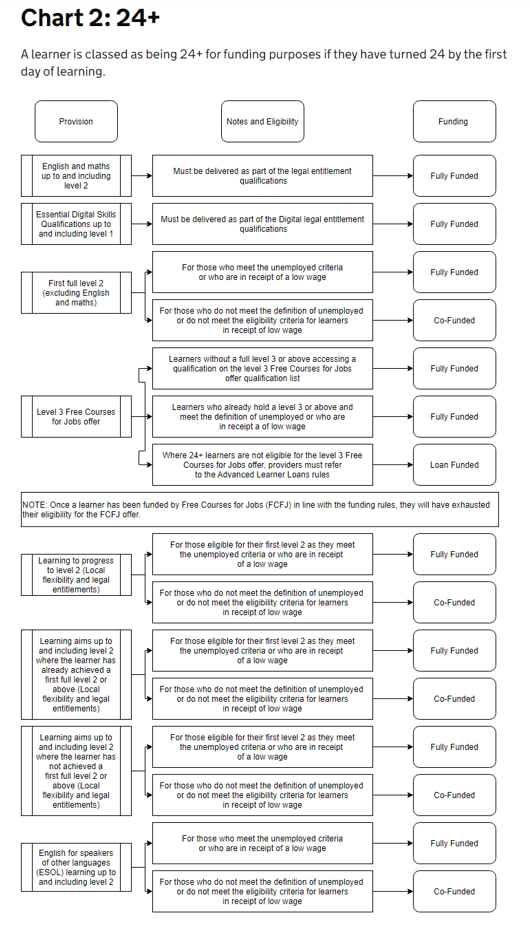

Government contribution table 2: 24+

A full set of funding rules in relation to 19+ learners can be found in the ESFA funding guidance for Adult Education Budget: draft funding and performance- management rules here

Low wage flexibility referred to must be eligible for co-funding and earns less than £20,319 annual gross salary.

Exam fees

No exam fee to be charged as tuition fee is set at the maximum loan/weighted fee available. Fees may be charged for re-sits and/or retakes.

Kits and Uniforms

Basic kit and uniforms will be made available where applicable. In certain areas students will be encouraged to purchase their own kit, which they can take with them when they leave.

Unemployed status

For funding purposes, ESFA define a learner as unemployed if one or more of the following apply, they:

Adult Education Provision – resident of another devolved area

The College does not have a funding allocation for any other devolved area and therefore any adult learner from a devolved area would be unfunded and subject to a tuition fee.

The LCRCA has an arrangement for AEB Cross Border Learners with Greater Manchester Combined Authority however, this will be included in the main AEB allocation. This reciprocal arrangement does not apply to the National Skills Fund Level 3 Adult offer.

Higher Education fees

The Consumer Protection guidance for HEIs require that fees must be set and published in good time for the marketing cycle therefore fees for 2024/25 are:

| Full-Time Courses | 2023/24 | 2024/25 |

| BA / BSc (3 years) FT – Year 1 | £8,400 | £8,400 |

| BA / BSc (3 years) FT – Year 2 | £8,410 | £8,400 |

| BA / BSc (3 years) FT – Year 3 | £8,278 | £8,410 |

| BA / BSc Top up (1 year) FT | £8,400 | £8,400 |

| Foundation Degrees- Year 1 | £8,300 | £8,300 |

| Foundation Degrees -Year 2 | £8,278 | £8,300 |

| HNC | £6,700

(except £7,400 for C&E*) |

£6,700

(except £7,400 for C&E*) |

| HND – top up | £6,700

(except £7,400 for C&E*) |

£6,700

(except £7400 for C&E*) |

| PGCE/PGDipE/Certificate in Education FT | £8,450 | £8,450 |

| Part-time HE Courses | 2023/24 | 2023/24 |

| PGCE/PGDipE/Certificate in Education PT – Year 1 | £4,200 | £4,200 |

| PGCE/PGDipE/Certificate in Education PT- Year 2 | £4,205 | £4,200 |

| Foundation Degree Dental Technology (3 year) – Year 1 | £5,600 | £5,600 |

| Foundation Degree Dental Technology (3 year) – Year 2 | £5,607 | £5,600 |

| Foundation Degree Dental Technology (3 year) – Year 3 | £5,519 | £5,607 |

| HNC (2 year) – Year 1 | £3,350

(except £3,700 for C&E*) |

£3,350

(except £3,700 for C&E*) |

| HNC (2 year) – Year 2 | £3,338

(except £3,698 for C&E*) |

£3,350

(except £3,700 for C&E*) |

| BA/BSc Top up (2 years) PT – Year 1 | £4,200 | £4,200 |

| BA/BSc Top up (2 years) PT – Year 2 | £4,205 | £4,200 |

* C&E is Construction and Engineering. The higher rate applies to all programmes in these subject areas only.

HE bursaries are offered subject to eligibility criteria.

In future years we anticipate increasing the fees in line with the annual inflation level (capped at RPI All Items Excluding Mortgage Interest (RPIX)).

For EU students with settled or pre-settled status and Irish citizens, the rate is the same as the Home Fees. The College does not currently offer courses for international students, including those from Europe, who require a visa to study in the UK.

The College does not currently offer courses for international students outside the EU. For students from within the EU, the rate is the same as the Home Fee.

Apprenticeship Provision

| 2023/24 | |

| Employer Fees for Apprenticeships (non-levy paying employers) | Employers will be required to pay 5% of the cost of apprenticeship training with the government paying the remaining 95% |

| Employer Fees for Apprenticeships (levy paying employers) | Employers will be required to pay for the apprenticeship training from their apprenticeship service account |

| Employer Fees for Apprenticeships (levy paying employers) who do not have enough funds in their apprenticeship service account | Employers will be required to pay 5% of the cost of apprenticeship training with the government paying the remaining 95% |

Managing Agents (Indirect Apprenticeships)

| 2023/24 | |

| Infill | All 2023/24 new starts will be agreed on a case-by-case basis by the Executive team. It is expected that the Training Provider will pay the College 80% of the funding received for the competences being delivered. |

Schools Provision

| 2023/24 | |

| Discrete group (hourly rate) | Schools – Minimum of £140 per hour (plus materials & exams); however, the College reserves the right to negotiate rates with individual schools |

| Infill (per hour) aged 14-19 | Minimum of £10 per hour; however, the College reserves the right to negotiate rates with individual schools |

| Alternative Provision | As specified in the Alternative Provision contract with Liverpool City Council |

| Additional learning support | Specific rates to be determined based on students’ identified needs. |

Other Charges

| Other Charges | 2023/24 |

| Income Generation Activities | Refer to list of fees for specific courses |

| Additional learning support for students on IG courses | Specific fees to be determined based on students’ identified needs. |

| Adult Safeguarded Learning | Refer to list of fees for specific courses |

| ID card replacement (staff and students) | £2 (one replacement card per annum provided free of charge) |

| Instalments

Threshold at which payment by instalments is available (subject to terms and conditions) |

Course fee in excess of £250 and course duration over 12 weeks |

| Instalment administration fee | £12.50 +VAT |

| Private candidates | Examination fee plus administrative fee |

Instalment arrangements for students paying their own fees

ESFA Funded courses, Income Generation and HE:

Instalment offer is subject to students meeting the terms and conditions.

For enrolments taking place in September on a 1-year course, up to 8 instalments and up to 15 instalments for 2-year courses. The number of instalments decreases depending on the date of enrolment and length of course.

First instalment is due at enrolment. See “Student Payment of Course Fees” document for further details.

NB: For learners experiencing financial difficulties, it may be possible to make payment arrangements with Financial Services via automated collection from learner’s debit / credit cards.

In certain circumstances, the College may remove the option to pay by instalments when there is a risk that non-recovery of fees may result in the course not being financially viable. The Deputy Chief Executive is delegated to approve an amendment where it makes commercial sense to do so.

Apprenticeship fees

Employers should be encouraged to pay the full amount up front. Where instalments are requested, the following will apply:

If a learner withdraws, the college will retain the first 50% of the employer contribution. The employer will be refunded the remaining 50% contribution pro rata over the duration of the framework.

The Deputy Chief Executive is delegated to approve an amended payment schedule where it makes commercial sense to do so.

Fee reassessment/refund

Fees are refundable in full if the College cancel the course.

In certain circumstances, students may be eligible for a refund/reassessment of the fee which is documented in the College Fee Reassessment / Refund. The student must complete the Student Application Form and in line with the policy, the College may authorise a refund for a proportionate amount of the tuition fee applicable to the remaining classes of the course which the student will be unable to attend.

A copy of the College Fee Reassessment / Refund procedure is available upon request from the Finance Department.

Download Tuition Fee Policy 2023/24 HERE